While making observation on the previous year’s budget the following comments were made “In fact it was not much different from the budget of the previous years and the observations made last year will apply to the budget of 2023-24. There is a general tendency to inflate both the receipts and expenditure though the trend is that the actual are in the range of around 70% of the estimated figures. In other words, the budget estimates are rather far from reality and are padded up to look good.” This observation still holds good for the current year’s budget also.

The budget presented before the House is an estimate, the estimation done based on certain parameters but the estimate goes haywire so much so that the actual are say in the range of 70-75% only in terms of receipts or expenditure; it indicate a fundamental flaw in estimating the receipts and the expenditure. Some of the fundamental flaws were raised by an MLA during the general discussion on the budget on the floor of the House but the reply was not forthcoming and it is expected that the reply will be provided during the discussion on the relevant Appropriation Bill.

As an example, the RE for 2022-23 show a revised estimate of Rs. 2500 crore as SOTR while the actual was only Rs. 1867 crore (74.68%). The revenue and capital expenditures were estimated in the RE for the same year at Rs. 19593.71 crore and Rs. 16288.71 crore respectively, the actual were only Rs. 14158.98 crore (72.26%) and Rs. 12896.54 crore (79.17%) respectively. The most worrying aspect in the capital expenditure in 2022-23 is that against the Capital Outlay of Rs. 8552.55 crore the actual was Rs. 3484.34 crore (40.74%) while the provision for the Discharge of Internal Debt was Rs. 7688.57 crore against which the actual was Rs. 9357.96 crore (121.71%) indicating higher short term borrowing like Ways & means and Overdrafts from the Reserve Bank of India to tide over acute financial distress, which is to be repaid within a prescribed period. Low Capital Outlay means less investment on creation of assets.

Chief Minister in charge of Finance in his speech stated that the economy of Manipur has been affected by unrest as it reduces revenue collection, increased expenditure on security and relief operation, inflation, difficulties in the movement of goods and services, difficulties in the implementation of projects and schemes, etc. This is the real situation the state is currently facing and the statement is the real reflection of the economy of the state after the start of the current crisis and it was expected that the figures will also show such concern. When the BE for 2023-24 was prepared, the state’s economy was in the right direction after the serious impact from COVID pandemic.

A number of entrepreneurs had started initiatives and the Government also came up with various schemes for their support. However, .if one looks into the GSDP figure as shown in the Budget at a glance, one is a bit surprised. The GSDP of the state as indicated for 2022-23 of Rs. 37,043 crore was increased to Rs. 45,145 crore (a growth of 21.87%) in the BE 2023-24 and with the then prevailing situation in February 2023 when the budget was prepared one may say that despite the high projected growth it reflects the positive sentiments.

But when the RE for 2023-24 was prepared this year, the state had already faced the brunt of the current crisis and its impact on the economy of the state with many entrepreneurs closing shops and even the state government had requested banks for providing moratorium on the loans availed. It was expected that the GSDP figure for 2023-24 will be reduced in the RE projections due to the current crisis. But no, it was increased to Rs. 45,558 crore which is 1% growth over the BE figure and 23% growth over the 2022-23 figure. This year 2024-25, all knows that the state economy is at the breaking point and the statement of the CM also hints towards this but despite this the GSDP for 2024-25 was estimated at Rs. 49,937 crore showing a growth over the RE figure of 9.61%, and can be attained only from the inflation which last year was a double digit at 10.39%.

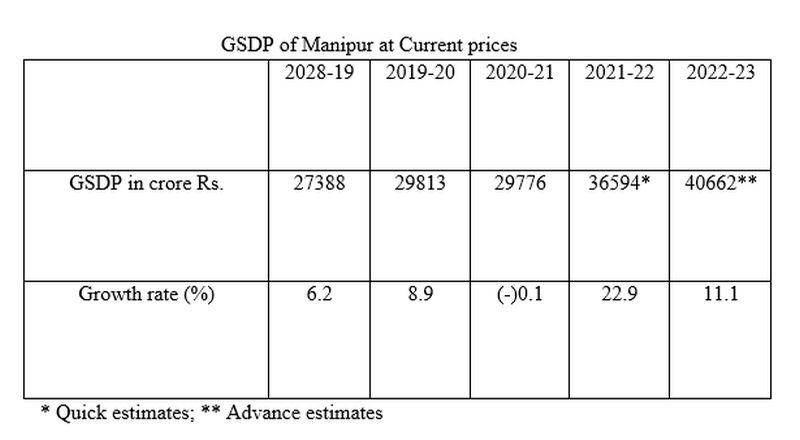

The economy is down in 2024-25 as compared to 2023-24 due to various factors including law and order issues and as mentioned many businesses had closed shops. There are steps in estimating the GSDP starting from Advance estimate, Quick estimate, Provisional estimate, Revised estimate and Final estimate and based on the methodology adopted the figure may be different and thus GSDP always remain as an estimate. The question is whether the GSDP incorporated in the Budget at a Glance was based on the figures furnished by the Directorate of Economics and Statistics, the nodal agency or merely figures produced from the hat. The Economic Survey 2022-23 recently placed on the floor of the House showed the GSDP of Manipur for the last five years as below:

One issue is when Government of India can publish Provisional data for 2022-23, and revised data for 2021-22, why is Manipur still continuing with the Advanced Estimate and Quick estimates for the said years and not go along with the GoI time schedule? In the Budget at a Glance for 2024-25, the GSDP used for 2022-23 is still the old figure of Rs. 37,043 crore, instead of Rs. 40,662 crore as indicated in the Economic Survey. This indicates lack of convergence among the various agencies involved in budget preparation.

It will not be possible to go through each Demands of Grants or the head wise receipts under each head of accounts. However, one major Heads of Accounts under SOTR is discussed to highlight the overestimation. State GST collection as per the Annual Financial Statement is Rs. 1426.15 crore, while the BE 2023-24 estimated it at Rs. 2374.56 crore and the RE figure for the same year is Rs. 971.00 crore. The collection during 2023-24 is assessed to be around Rs. 1,100 crore, better than the RE figure. The provision for 2024-25 is now placed at Rs. 1426.15 crore which if the situation prevails now continues is likely to be difficult to attain.

The situation prevailing during the current year is mostly similar to that of last year. Hence a hike of say nearly 30% seems unrealistic. Though improvement on the law and order problem can make the target attainable, at present even in the middle of the second quarter, there is hardly any improvement. More government investment through creation of assets by way of higher Capital Outlay can make the target achievable but with serious liquidity crunch, the provisions under Capital Outlay is unlikely to be fully spent.

On the expenditure front, under Pensions and Retirement Benefits the actual was Rs. 2880.43 crore in 2022-23. In the BE of 2023-24 the provision was 2537 crore while in the RE, it was Rs. 2777.48 crore. Despite such provisions, there is a backlog of pensionary benefits to the tune of Rs. 808 crore which are yet to be paid to the pensioners as indicated in the reply to Starred Question No. 237 and in the reply to the supplementaries the Chief Minister observed that the pending amount will be released. But the provision does not reflect the statement as the provision will be able to meet only the current liabilities and not the overdue payment.

The pensionary provisions need to keep pace with the increase in life expectancy. In 1973, the life expectancy was 49.7 years for India while in 2012 it had reached 67.9 years. The estimation of NFHS was for 2015-16 is 66.6.years for India while for Manipur it was 70.10 years. In other words, pensioners live longer and the pension payment have to cater for a longer period and this need to be reckoned while estimating the requirement. Further, large number of employees is retiring and till the employees under the Old Pension Scheme fully retires; the requirement will continue to grow. Once all such employees retires, the requirement will slowly go down but will never come to zero as the Government contribution to the new pension scheme and the leave encashment benefit will continue to be charged under this head.

A couple of examples where the preparation of the budget seems to disconnect with the reality was discussed above, and it is reemphasised that budget preparation is a serious business and any mis-estimation will be found out in a short time.